Most Recent

- Accounting

- Business Owners

- Australian Taxation Laws

- Financial Planning

- Tax Planning

- Superannuation

- ATO

- Home Owners & Investors

- Professionals

- Family Business

- 23/24 Financial Year

- Trusts

- 24/25 Financial Year

- Case Studies

- Construction

- Renewable Energy & Environment

- Personal Income Tax

- Insurance Underwriting

- Self Managed Super Funds

- Payroll Tax

- WLM News

- 22/23 Financial Year

- 25/26 Financial Year

WLM is proud to share an inspiring story from one of our clients, Victoria Lewis, founder of Business Activators and MPreneurs.

A recent decision of the Administrative Review Tribunal (Goldenville Family Trust v Commissioner of Taxation [2025]) highlights the importance of documentation and evidence when it comes to tax planning and the consequences of not getting this..

The Chief Commissioner has recently assessed Uber as liable for payroll tax and interest in the sum of approximately $81 million for the financial years 2015 to 2020 pursuant to the Payroll Tax Act 2007 (NSW) (Payroll Tax Act).

This decision has..

With the purchasing of luxury vehicles on the rise it’s important to be aware of some specific features of the tax system that can impact on the real cost of purchase. Often the tax rules provide taxpayers with a worse tax outcome if the car will be..

The Fair Work Commission has determined that a Philippines based "independent contractor" was an employee unfairly dismissed by her Australian employer.

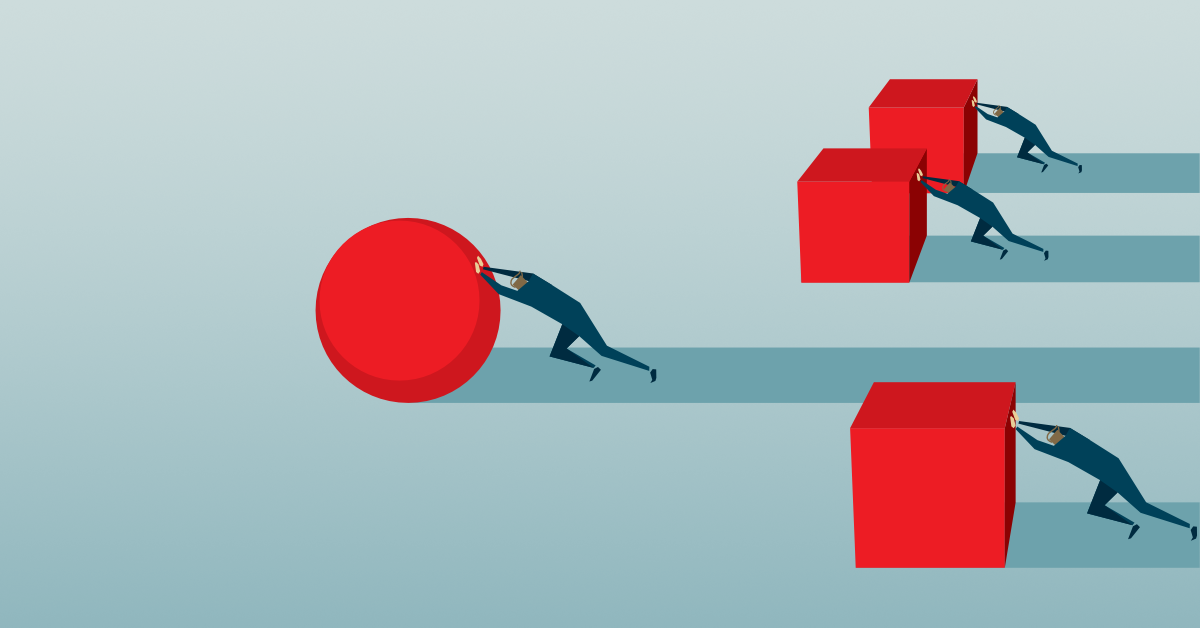

Many professionals and businesses look to save tax and minimise risk by setting up companies and family trusts.

Generally, the more complex your structure, the more tax you may save but there are pitfalls in creating overly complex structures.

Here..

As we come to the end of the 2023 financial year, I hope you have all had a successful year. It is never too early to look at the year ahead and set financial goals. When setting your financial goals, it’s important to make them “SMART”: Specific,..

Goals-based financial planning is a signature of our service at WLM, because it involves much more than the numbers – it also explores measures that provide security and protection against unexpected life events. Sadly, and too often, we hear of..

The directors of an established not-for-profit organisation came to WLM Financial concerned that they weren’t getting coherent reports and information, and as a result couldn’t make strategic decisions.

A general medical practice needed us to review their contractual arrangements following a laborious payroll tax audit. Unfortunately, the NSW Office of State Revenue (OSR) had earlier determined that all doctors working on a service fee arrangement..

.png)