Financial Planner

Recent Posts

Most Recent

- Accounting

- Business Owners

- Australian Taxation Laws

- Financial Planning

- Tax Planning

- Superannuation

- ATO

- Home Owners & Investors

- Professionals

- Family Business

- 23/24 Financial Year

- Trusts

- 24/25 Financial Year

- Case Studies

- Construction

- Renewable Energy & Environment

- Personal Income Tax

- Insurance Underwriting

- Self Managed Super Funds

- Payroll Tax

- WLM News

- 22/23 Financial Year

- 25/26 Financial Year

Those with large superannuation balances will be disappointed that the 30% tax on super earnings on balances above $3 million remains in place, this is set to commence from 1 July 2025.

From 1 July 2024, the amount you can contribute to super will increase. We show you how to take advantage of the change.

Australians love property and the lure of a 15% preferential tax rate on income during the accumulation phase, and potentially no tax during retirement, is a strong incentive for many SMSF trustees to dream of large returns from property..

The ‘Santa Claus Rally’ arrived for global share markets as the long-awaited pivot in monetary policy from the US Federal Reserve arrived at its December meeting. Although the Fed kept the federal funds rate target on hold, it flagged the current..

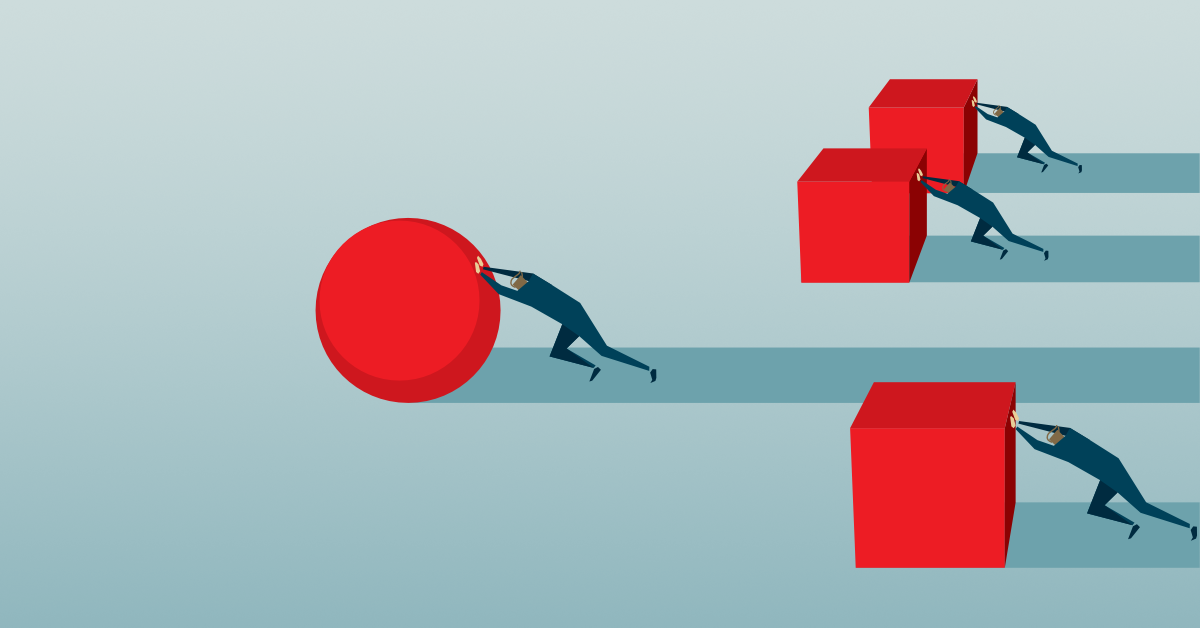

Sometimes the first step in being able to plan for the future is to be able to make a big decision about something in life. However, what happens if there is a stumbling block keeping you awake at night that you just can’t seem to move past?

As part of WLM's financial planning philosophy, we sit with clients and tailor our advice to their individual goals. Part of this process is to work out their cashflow needs to live comfortably in retirement and how much they need as an asset base..

Intergenerational wealth transfer is the process of passing assets, wealth, and financial resources from one generation to the next, typically from parents or grandparents to their children or grandchildren. Effective financial planning for..

Over the last few months, WLM has held a lot of Annual General Meeting (AGM’s) with our business clients. The purpose of the AGM is to get the client, WLM accountant and financial planner in the same room to review business cashflow and..

I hope you all had a prosperous 2023 Financial Year. At WLM, we spent a lot of time with our clients working on strategies to save tax in the lead up to 30th June.

As we come to the end of the 2023 financial year, I hope you have all had a successful year. It is never too early to look at the year ahead and set financial goals. When setting your financial goals, it’s important to make them “SMART”: Specific,..