How increasing inflation is eroding the value of your cash

In December 2020, Reserve Bank of Australia (RBA) Governor, Philip Lowe, issued a statement that the official cash rate is likely to remain at 0.1% until 2024, the lowest cash rate in Australian history. With a cash rate of almost zero for the next few years to come, individuals, families and organisations with large cash holdings should consider the hidden force eating away at the real value of their wealth.

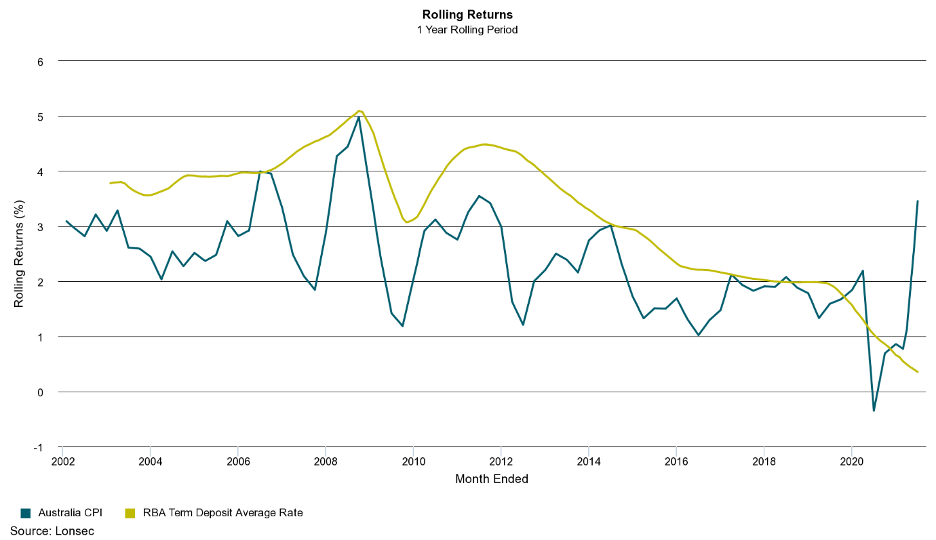

The chart below shows one-year returns from a basket of term deposits (light green line) compared to Australian inflation (dark green line). When the term deposit line sits above the inflation line, the purchasing power of money held in cash is maintained. However, when the term deposit line is below the inflation line, the cost of living increases more than the return on cash (e.g. you can now buy less with the same amount of money compared to a year ago). While this has historically been a rare occurrence, central bank policy to lower interest rates over recent years has forced this scenario. The situation is worse if you pay tax, as tax paid further reduces your return on cash.

While inflation has spiked recently due to the reversal of some COVID-19-related price reductions, many commentators believe low cash rates are likely to stay for the foreseeable future due to high levels of debt (both government and household), ageing demographics and low wage growth, all of which will keep a lid on inflation over the long-term. If interest rates do rise, it will be in a slow and methodological manner.

WLM can assist with your investment needs

Cash may no longer be a ‘risk-free’ asset, as inflation eats into the real value of your money. While we stress the importance of maintaining a healthy cash buffer to provide flexibility, there are higher returning alternatives that don’t involve taking a significant amount of additional risk for funds not immediately required. We work with our clients to tailor investment portfolios to match their desired wants and needs.

If you'd like help with understanding how active portfolio management can help lessen risk for your Cash and other investment, contact us today.

The material and contents provided in this publication are informative in nature only. It is not intended to be advice and you should not act specifically on the basis of this information alone. If expert assistance is required, professional advice should be obtained.